How Credit Score Affects Your Insurance Rates

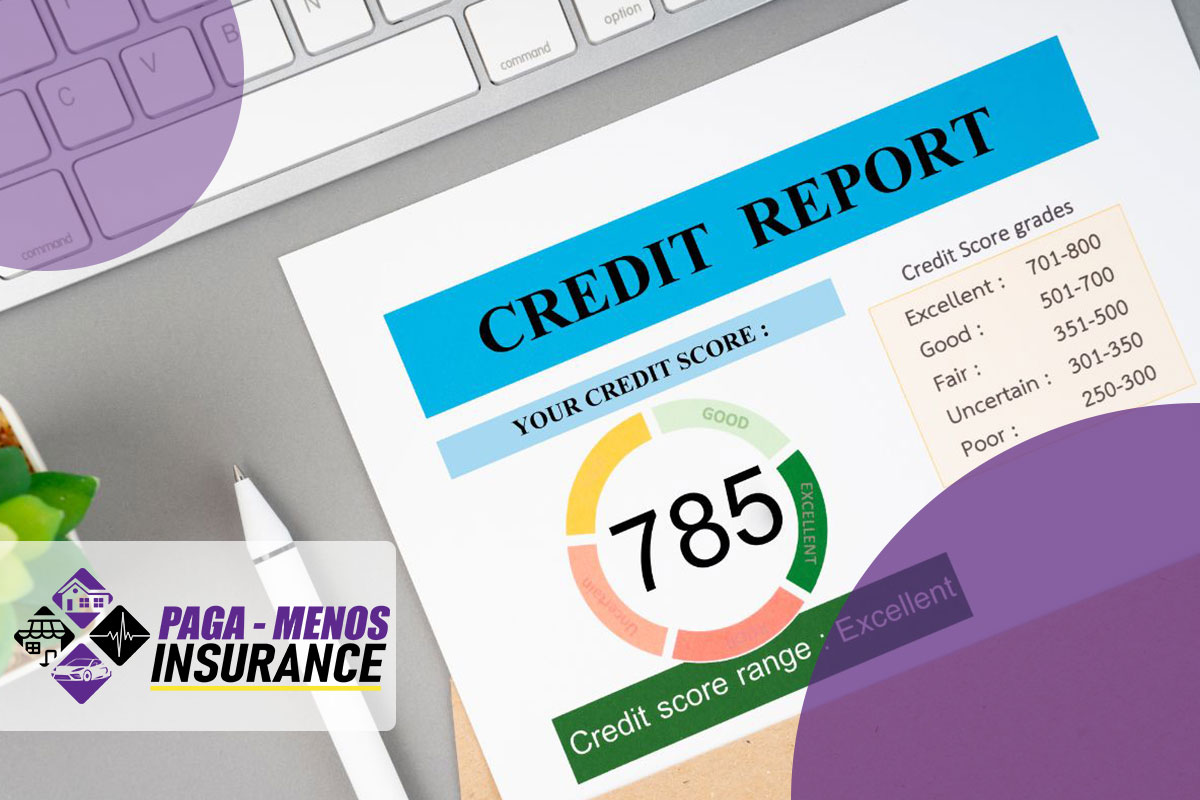

Did you know how credit score affects your insurance rates? It is crucial in determining your premiums. This might come as a surprise, but it’s true. A robust credit score does far more than assist in securing loans; it significantly influences the cost of your insurance.

This vital link is often overlooked, yet it can profoundly impact your financial well-being. Grasping this relationship is the first step towards effectively managing your expenses and achieving economic stability.

Let’s dive into how your credit score shapes your insurance rates.

How Credit Score Affects Your Insurance Rates

Your credit score serves as a financial fingerprint. It reveals how responsibly you manage credit. Surprisingly, this score also affects your insurance rates. Let’s explore why and how this happens.

The Link Between Credit Score and Insurance Rates

Insurance companies use credit scores to predict risk. A high score suggests financial stability. Consequently, insurers view you as less risky. This can lead to lower insurance premiums. On the other hand, a lower score might increase your rates.

Factors Influencing Your Credit Score

- Payment History: Timely payments improve your score.

- Credit Utilization: Using a small portion of your credit limit is beneficial.

- Length of Credit History: A longer credit history can positively affect your score.

- Types of Credit: A mix of credit types (e.g., mortgage, credit cards) is advantageous.

- New Credit: Opening several new accounts in a short period can lower your score.

How to Improve Your Credit Score

Improving your credit score can lead to better insurance rates. Here are some tips:

- Pay Bills on Time: This shows insurers you’re financially responsible.

- Keep Balances Low: High balances can negatively impact your score.

- Monitor Your Credit Report: Check for errors that might hurt your score.

- Limit New Credit Applications: Only apply for new credit when necessary.

Frequently Asked Questions

- Q: Can improving my credit score lower my insurance rates?

- A: Yes. A higher credit score can lead to lower insurance premiums.

- Q: How often do insurers check my credit score?

- A: This varies. Some may check annually, while others do so less frequently.

- Q: Does every insurer use credit scores?

- A: No, but many do. It’s a common practice to assess risk.

Improving your credit score is a proactive way to manage your insurance costs. It benefits your financial health and opens doors to more favorable insurance rates.

Trust Pay Less Insurance for Your Needs

At Pay Less Insurance, we understand the importance of affordable, reliable insurance. Our professional services are designed to meet your unique needs, ensuring you’re always covered.

With us, navigating insurance becomes simpler and more transparent.

Ready to experience lower rates and unparalleled service? Contact Pay Less Insurance